Friday Wrap is intended to bring you expert TA to help you get positioned for the week ahead. This series is brought to you by Mark Simpson, a Wharton MBA and a TA enthusiast of over a decade.

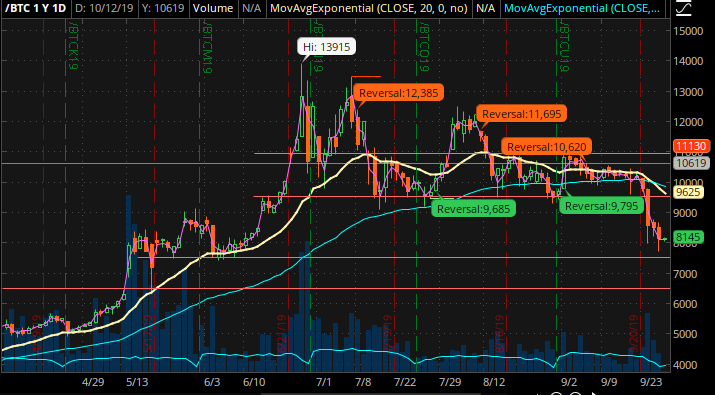

So three weeks after my prior post, Bitcoin [crypto]bitcoin[/crypto] price action has spoken. The plan (if you stuck to it) would have worked like a charm. You would have sold out of one unit at the top of the trading range and then clipped out of the second unit right at $9,500. You could’ve either gone short or just waited for a new entry on the long side and you’d be feeling pretty good about yourself. Now it’s time to see what’s next for this wild maniac bug of a trading vehicle.

$9,500 broke, so you should either be short or flat. $8,100 appears to be providing some support but I don’t see a good reason why, so I’d still be cautious. The next true support I see, based on the burst of buying that the level triggered in early June is $7,500. You could try a nibble there, either to build a long term position or with a tight stop. The next support comes at $6,500 which was the starting point for a big gap up burst in early May and has some foundation from November 2018.

Just remember Bitcoin trades as it trades. Be prepared with a good thesis or a plan so when moves like this happen, you aren’t scrambling for reasons after the fact. GLTA and save your capital at all costs!