Friday Wrap is intended to bring you expert TA to help you get positioned for the week ahead. This series is brought to you by Mark Simpson, a Wharton MBA and a TA enthusiast of over a decade.

While I’m not an expert in Bitcoin [crypto]bitcoin[/crypto] price action, I have been trading equities for 12 years and have found Technical Analysis to be the most useful tool in the box. Remember it was developed 1,000+ years ago in the Japanese rice trading markets and still works today! Since BTC doesn’t have traditional fundamentals, it’s a prime candidate for TA. I have found multiple EMAs (exponential moving averages) combined with Support/Resistance to be the most useful tools within the TA shed. The following daily charts can show you a very high-level view of what I think may be happening now.

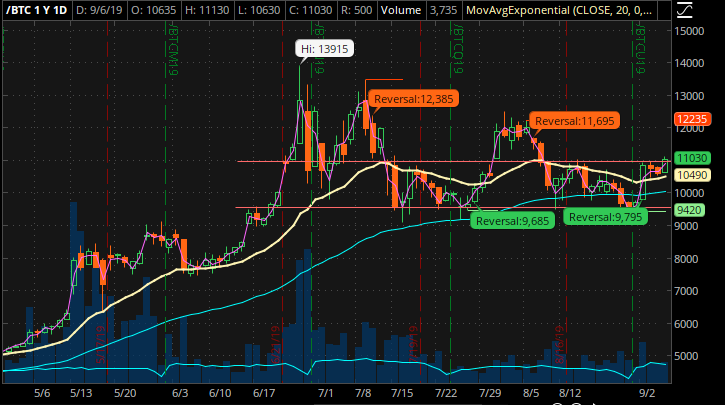

As you can see in the first of these two daily charts, a new trading range has been created. 9500 was tested and it held. Now, 11,000 is resistance. The two EMAs (20-day and 60-day) are still trending up but are flattening out. The order they are in (20 above 60) indicates the trend is still bullish but the trajectories indicate the trend is pausing.

That said, it’s pretty clear that any movement between these two levels is churn. A break above 11,000 would meet resistance at 12,000. If it can break through that, new highs can be achieved. If it falls through the 9,500 level, there isn’t much stopping it before 8,000 or below.

I know this is a lot of if/then thinking, but the most important thing in trading is to have a plan and stick to it. Hoping it will do something leaves you at the whim of the market. It’s better to have a rational plan involving risk management and stops than to just enter a trade and hope it works out “because 9,000 seems like a good price” or some other false logic. For this set-up, I’d try a 2 unit strategy. 1 unit to trade the churn and a 2nd unit to get set up for either breakout above 11k or a breakdown below 9.5k. If you are short above 11k or long below 9.5k, you are on the wrong side of the trade and then you are hoping. Don’t hope, execute the plan. GLTU